| Wind Watch is a registered educational charity, founded in 2005. |

Please note that opinion pieces (including letters, editorials, and blogs), reflect the viewpoints of their authors; National Wind Watch does not necessarily agree with them in their entirety or endorse them in any way, nor should it be implied that the writers endorse National Wind Watch.

Beyond FIT 2.0: What’s in store for wind in Ontario

Credit: BY ANDREW CHANT & KA-MING LIN, North American Windpower, Volume 9, Number 9, October 2012 ~~

A decision to prioritize microFIT applications and First Nations involvement may upset some utility-scale wind developers.

There may be trouble brewing in Ontario. The problem stems from a potentially explosive mix of low demand, surplus generation and rising power prices. If Ontario’s feed-in-tariff (FIT) program had a political risk meter, the needle would be hovering around the red zone.

Recently, the Ontario Power Authority (OPA) updated its guidelines for renewable energy procurement. The OPA continues to encourage greater involvement with Aboriginal and community groups, whereas the province’s further development of larger wind and solar projects has been de-emphasized. These priorities may be troubling to some developers; however, there are some very legitimate policy reasons for the OPNs actions.

First, the decline of Ontario’s manufacturing sector has led to a surplus of generation, resulting in flat demand. The slow or negligible growth in demand, combined with the Bruce nuclear generators’ return to service, will exacerbate the surplus baseload generation problem that is estimated to persist until 2017.

When surplus baseload generation occurs, nuclear facilities may be forced to “maneuver” (i.e., be curtailed). Nuclear facilities are expensive to curtail and require 72 hours to be brought back online. Again, due to the lack of demand, spot prices are extremely low: In 2008, they averaged about C$30/MWh, and in 2011, they were closer to C$20/MWh.

Consumers pay the spot price for electricity, with some downward adjustments made for small consumers. Theoretically, a combination of low or stagnant demand and surplus generation should lead to lower electricity prices, which actually occurs if only the kilowatt-hour charges for delivered electricity paid by the consumer are considered.

Beyond FIT 1.0

Contracts under FIT 1.O, and other contracts entered into by the OPA, are fixed price. With the exception of solar, FIT 1.0 prices are 100% indexed to the consumer price index (CPI) prior to the commercial operation of the project.

In 2009, FIT prices for wind were set at C$0.135/kWh, whereas ORTECH estimates that wind projects commissioned today will receive in excess of C$0.14/kWh, with 20% of the price at commissioning escalated at the CPI for the next 20 years. The difference between the spot price and the fixed price paid under the OPA contracts goes into an account – called the global adjustment – that is charged to consumers based on the kilowatt-hours consumed.

For every megawatt -hour of wind power produced based on a starting price in 2012 of C$140/MWh, the global adjustment increases by C$110 to C$125. ORTECH calculates that for the wind projects contracted under FIT 1.O, the global adjustment will increase C$700 million from approximately C$5 billion in 2011 to approximately C$5.7 billion in 2015.

The rapid increase in the global adjustment means that even with a lower spot price, consumer electricity bills will rise substantially. In fact, government estimates peg electricity bill increases at 7.9% between 2010 and 2015. Compounding the problem is that as of Dec. 31, 2011, only 10% of the contracted wind energy under the FIT 1.0 program has been commissioned; the remainder is coming online between now and 2014.

Moreover, an additional 935 MW of larger wind facilities that are scheduled to come online between this year and 2014 are not included in the OPA’s summary of FIT 1.0 contracts under development. ORTECH estimates that these projects will add an additional C$200 million to the global adjustment. For wind alone, the increase in global adjustment from 2011 to 2015 may be up to C$900 million, or lS% over the 2011 amount, representing a cumulative additional global adjustment payment of C$1.6 billion from 2012 to 2014. These increases are based on an average hourly Ontario electricity price (HOEP) of C$301 MWh. Accordingly, these estimates may be understated, because the starting prices of some large non-FIT contracts are unknown.

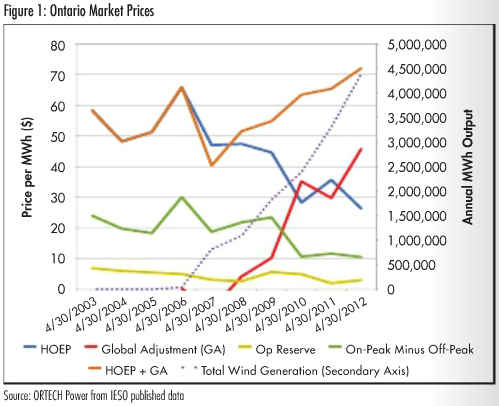

Data culled from Ontario’s Independent Electricity System Operator (IESO) illustrates what is happening to electricity prices in the province (see Figure 1). The blue line shows the gradual decline in the HOEP since 2006, and the red line charts the increase in the global adjustment. the dotted line represents the increase in annual wind output in megawatt-hours.

Here’s what is ominous for the wind industry: The ochre-colored line at the top right, which represents the sum of the HOEP and the global adjustment, is increasing at the same rate as wind generation.

Electricity in Ontario is a sensitive political issue, not only because the transmission system is provincially owned, but also because 60% of the generation supply is controlled by the province. The rapid rise in power prices caused by the projected increase in the global adjustment could have an adverse effect on the wind industry. With the Dalton McGuinty government in power in Ontario and the major opposition party calling for a moratorium on wind, the situation may be precarious for the FIT program and, by extension, the wind energy sector.

The OPA’s proposed order of priorities is prudent and in the long-term best interest of the wind industry. There are about 60,000 micro FIT applications in the system. These will have a minimal effect on the global adjustment, but at an estimated two voters per household, this translates into 120,000 or more votes in favor of retaining the FIT program. Community projects should also increase the popularity of wind energy.

In addition, the IESO is responding to the oversupply of generating capacity by planning to make wind dispatch able. Under the current rules, this means that wind generators will be paid to not produce – a reality that may be politically unpalatable during time of economic uncertainty and rising power prices.

However, there are many proactive measures companies can take to promote wind energy development.

First, the industry should stress the number of jobs that are created by constructing the projects that are already on the books, as well as larger projects under development.

Second, they should focus on the Darlington nuclear plant refurbishment, which is scheduled for 2017; this is when the majority of the wind farms will be operating and the surplus power problem will be abated.

Third, developers should site wind facilities in areas where there is strong community acceptance. Areas home to cottages and hobby farms should be avoided, as these part-time residents usually have the means to fund challenges, and in fragile political times – or even in the best of times no politician wants to support a controversial project.

Nonetheless, there are some factors that are more or less out of developers’ control, such as a lack of transmission capacity. In this instance, however, the hiatus in large-scale development may actually allow the transmission system to catch up so that there is capacity to absorb additional wind power.

There are five priority transmission projects outlined in the LongTerm Energy Plan, two of which involve upgrading existing lines in southwestern Ontario. These two projects will be required in order to accommodate the growth of renewables in the West of London area. A new West of London line, with a target completion date of 2017, may be deferred until there are indications that demand will increase.

The danger, of course, is that transmission lines are difficult and time-consuming to permit, and increases in demand may occur more quickly than transmission can be built. It is also possible that innovative solutions, such as storage, may be developed to alleviate the oversupply issue and to defuse potential objections to paying generators to not produce.

Finally, hope that demand picks up, because an expanding economy will blunt the pain of higher power prices.

Andrew Chant is managing director of renewable energy and Ka-Ming Lin is a senior renewable energy specialist at ORTECH Power. They can be reached at achant/ortech.ca and klin/ortech.ca, respectively.

This article is the work of the source indicated. Any opinions expressed in it are not necessarily those of National Wind Watch.

The copyright of this article resides with the author or publisher indicated. As part of its noncommercial educational effort to present the environmental, social, scientific, and economic issues of large-scale wind power development to a global audience seeking such information, National Wind Watch endeavors to observe “fair use” as provided for in section 107 of U.S. Copyright Law and similar “fair dealing” provisions of the copyright laws of other nations. Send requests to excerpt, general inquiries, and comments via e-mail.

| Wind Watch relies entirely on User Contributions |

(via Stripe) |

(via Paypal) |

Share: