| Wind Watch is a registered educational charity, founded in 2005. |

Civitas responds to wind power report concerns

Credit: 23 January, 2012 - Joseph O'Leary - fullfact.org ~~

Last week Full Fact outlined a charged debate surrounding a report published by the think-tank Civitas this month, in which it claimed that wind power was not economically viable for the UK.

RES – a company involved in the production of wind energy – had attacked the report for being “inaccurate and outdated”. Some of these concerns were illustrated by Full Fact’s own analysis.

After contacting Civitas for an explanation, they have duly provided one, along with further evidence justifying their assertion.

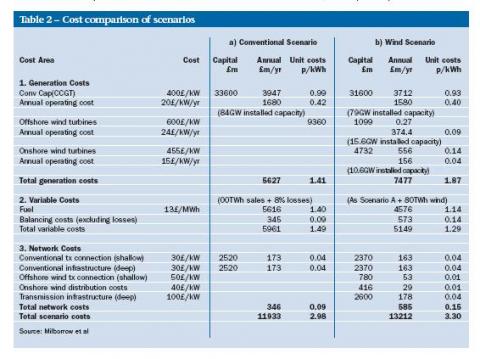

On the specific point of miscounting, the table below highlighted the source of much of the controversy:

The problem in the Civitas report stemmed from the fact that this set of estimates on the cost of wind power takes into account reserve costs of generating wind power at times of exceedingly low or high wind, and transmission costs of getting the power from the generators to energy consumers.

Civitas justify their re-inclusion of these costs on a number of grounds. Firstly, the estimates (from 2003) themselves underestimate the transmission costs due to their optimistic assumptions about ‘capacity credit’ (a measure indicating the amount of backup generation required to maintain nominal power).

Secondly, the think-tank stresses the acknowledgement given to the caveats involved in measuring the various costs of wind-power generation. Their own report, and that by Colin Gibson from which they draw some of their data, both acknowledge ongoing issues with their assumptions that require further scrutiny.

A full explanation of Civitas’ argument is provided below, in their own wording:

—–

The article by David Milborrow and others was published in the March 2003 Power UK. Prices have inevitably changed since then. Colin Gibson is careful not to make excessive claims for accuracy. His paper begins with the words:

‘This document has been prepared in good faith, and endeavours have been made to makeit as objective as possible using the author’s expertise together with reference to other documents. However,the results are for a specific set of input data chosen by the author, and IESIS and the author accept no liability for any loss or damage to others as a result of relying on information in this paper.’

The author recognises the lack of empirical data for some types of generation particularly with regard to the probabilities that should be assigned to the various levels for each input parameter. However, the methodology should be seen as an aid to provoking debate to draw out the best engineering judgement regarding these input parameters. At various places in the paper there are indications (in red)of areas where the author would welcome further debate and input. Levelised costs, whilst being a useful guide in considering long-term energy policy, are not a complete substitute for total system cost studies in planning a power system.

The validation analysis provided as an appendix to the Covering Paper comes to the conclusion that the results are likely to be indicative of the relative costs rather than provide accurate predictions of actual cost.

It is hoped that the information made available here will stimulate the commissioning of a corresponding study based on the more accurate total system cost approach. Resources to carry out such a study are not available to IESIS.

Ruth Lea draws attention to these caveats in her main text and again in the footnotes.

Gibson’s cost estimates, the caveats on the accuracy of which are discussed in his paper, are shown in table 1 below.

Substantive Issues

Ruth Lea’s paper serves to highlight this particular area of debate. Mainstream studies even without these intermittency costs, such as those by Mott MacDonald and Ove Arup cited, show offshore wind as among the most expensive options, more costly than gas or nuclear, without subsidies to support it. Onshore projects are cheaper but have their own amenity costs in damage to the landscape.

The issue of intermittency is less well known. A “capacity credit” of 20 per cent, as set out in the Milborrow article, really does mean that it takes five wind farms to deliver the nominal power from one. Improvements in storage and demand-management have the potential for greater benefits than building more wind farms.

The central study for DECC by Mott MacDonald explicitly excludes the costs of providing a reserve.

“It [levelised cost] does not take account of impacts on the wider electricity system (such as reserve and balancing requirements, nor does it consider special revenue support measures (ROCs or capital grants etc). (page i)”

Levelised cost regards the problem from the generator’s perspective, with the assumption that theywill be credited for each unit of energy produced. Reserve costs do not show up in such a study and are usually borne by a different provider, who needs to pass them on to the customer.

Intermittency has many aspects. The Milborrow paper, providing a £16/MWh price tag, discusses as a reasonable benchmark failing to meet peak demand nine years in a hundred. If people want a higher service standard there will be a higher price tag. Wind is subject to many forms of intermittency, all of which need to be addressed if supply is to be kept constant. For example, there are costs involved in getting fuel to a gas-oil power station that needs to be fired up quickly to make good a fall in wind output. As Parsons Brinckerhoff put it in the 2010 update to Powering the Nation:

“The peak duty (5%) for OCGT may be increasingly required to manage transient conditions when there are fast declines in wind generation as weather patterns cross the country. In this case the plant would need to be oil-fired as gas supplies would be unlikely to be delivered quickly enough through the gas network.”

Wind can drop suddenly and for long periods. It can also blow beyond safe generation levels. Demand does not always follow the same pattern. Renewable UK (the British Wind Energy Association) drew attention through the Guardian to a report, “Impact of Intermittency” by Poyry about the feasibility of high wind penetration.

This is a study by a mainstream consultancy and its assumptions are instructive. Page 40 of the report shows 30 GW of nuclear capacity being incompletely utilized so that intermittent wind-generated electricity could be used instead. Rapid-response generators need to command high prices. In a review of intermittency (page 13) by the same company, price spikes are envisaged up to £8,000/MWh.

Any study of wind-generated electricity needs to accept, as does Ruth Lea’s paper, that the costs are not all known. By drawing attention to these uncertainties and to the gap between a wind-farm’s nominal capacity and the 20 per cent capacity credit, she has served to advance public understanding.

Reconciling the Papers

Seen at one remove and without the itemization, via Parsons Brinckerhoff’s “Powering the Nation”, the Milborrow estimate appeared very low if it was required to cover more than just operational intermittency. Transmission costs alone amount to around £31/MWh, on the basis of the Gibson paper, which is based on the cost of an existing line to central Scotland. Once again, it is worth stressing that he is hopeful that better data may be made available. We would all welcome a total cost study into intermittency by National Grid, who are probably best placed to conduct it.

The large difference in estimates to provide security of supply may be traced to a differentassumption regarding capacity credit. Power UK in 2003 has 25GW of wind reducing conventional plant by 5GW. That is a capacity credit of 20 per cent. Following Eon’s evidence to the House of Lords Economic Affairs Select Committee (paragraph 10), the Gibson paper prefers 8 per cent. The smaller the capacity credit, the greater the costs of back-up generation.

Eon’s evidence contiunes:

“This effect could be to some extent mitigated by more extensive electricity interconnections with continental Europe (which would enable “back-up” power to be imported), the longer term development of new electricity storage technologies at a significant scale (which would be able to store power from the grid and produce it when required), or more demand side management capability which would enable demand to be varied in relation to the level of wind generation.”

The first of these options for mitigation, importing nuclear-generated electricity from France at times of peak demand, is the easiest to achieve. Existing storage facilities work better for managing predictable demand than unpredictable supply.

Summary

Ruth Lea follows Colin Gibson is seeking to draw attention to the costs of intermittency latent in wind power, but is very well aware how hard they are to quantify accurately.

Offshore wind is generally accepted as more expensive than other large-scale means of meeting demand for electricity. There are further potential uncertainties that detract from stability of supply and cost. These are more important from a customer’s perspective than from that of a generator.

Understanding of additional costs has developed since 2003. The Milborrow article in Power UK underestimated transmission costs. Scaling back optimistic assumptions about capacity credit increases the costs of intermittency.

This article is the work of the source indicated. Any opinions expressed in it are not necessarily those of National Wind Watch.

The copyright of this article resides with the author or publisher indicated. As part of its noncommercial educational effort to present the environmental, social, scientific, and economic issues of large-scale wind power development to a global audience seeking such information, National Wind Watch endeavors to observe “fair use” as provided for in section 107 of U.S. Copyright Law and similar “fair dealing” provisions of the copyright laws of other nations. Send requests to excerpt, general inquiries, and comments via e-mail.

| Wind Watch relies entirely on User Contributions |

(via Stripe) |

(via Paypal) |

Share: